Example for Incentive Details for Increased Revenues

Partners who meet the requirements for incentives granted for increased revenues will be automatically enrolled in the incremental incentive program. They can check the bills and details of incentives for increased revenues in Partner Center, or manually calculate the incentives to confirm that the incentives for increased revenues in the system are correct.

The system will automatically check whether partners meet the requirements and calculate the incentives for increased revenues.

Different incremental incentive programs have different policy requirements. Partners can view the incentive policy documents in Support > Document Library of Partner Center.

Viewing Details About Incentives for Increased Revenues

- Use your account to log in to Huawei Cloud.

- In the drop-down list of your account name, click Partner Center to go to the Partner Center.

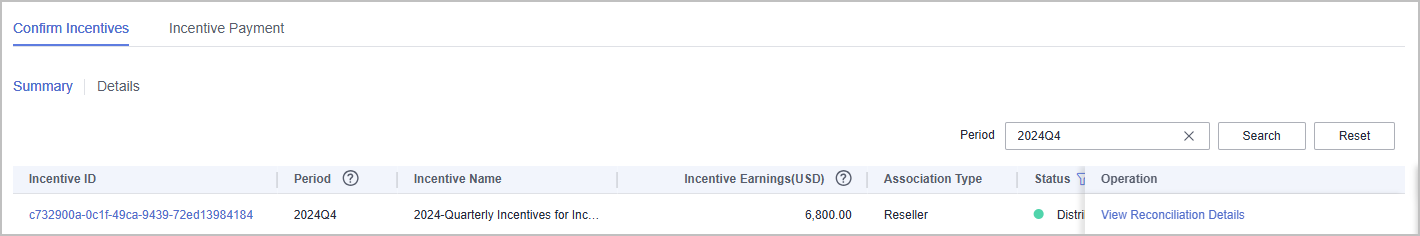

- Choose Sales > Incentives > Incentive Management in the menu on the top. The Confirm Incentives > Summary page is displayed by default.

- View the incentive bill summary information, including the period, incentive name, incentive amount, association type, status, and validity period.

- Incentive amount = Incentive base increment x Rebate. The rebate changes with the policy. To learn about the latest policy, go to Support > Document Library in Partner Center to check the relevant incentive policy document.

- The incentive amount for increased revenues is updated every day when the incentives are in the Estimated state. Partner Center only displays the estimated incentive earnings without showing the estimated details. That is, when you click View Reconciliation Details in the Operation column, you will only see the incentive summary data. The incentive earnings are not split based on the association type, so the Associated Type field displays as --.

- When the incentive earnings are the Pending confirmation state, click Confirm in the Operation column. Then, access the Sales > Incentives > Incentive Management > Incentive Payment page and request incentive payment.

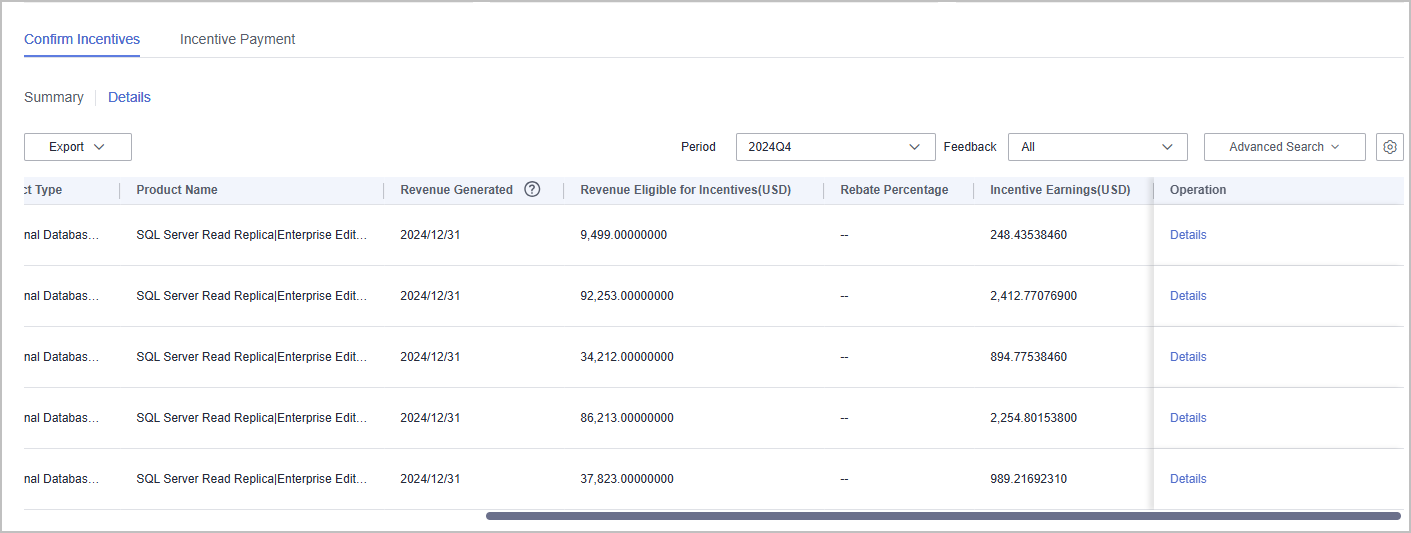

- Switch to the Details tab and click Details in the Operation column to view the incentive details, including the customer name, product name, product type, rebate, rebate rule, and product incentive strategy.

- Click Customize Column above the list and select other fields to view more information about incentives.

- Incentive for a revenue = Amount of the revenue × (Total incentive amount for increased revenues/Incentive base)

Manually Confirming the Incentive Amount for Increased Revenues and Viewing Incentive Details of a Revenue

The following uses the quarterly incentives for increased revenue in Q4 2024 as an example.

- Check the conditions for incentive rebate.

- Incentive threshold ≥ $30,000 USD

- Growth rate for the revenue of the quarter is at least 45% compared with that in the same quarter of the previous year.

- Confirm whether the conditions are met.

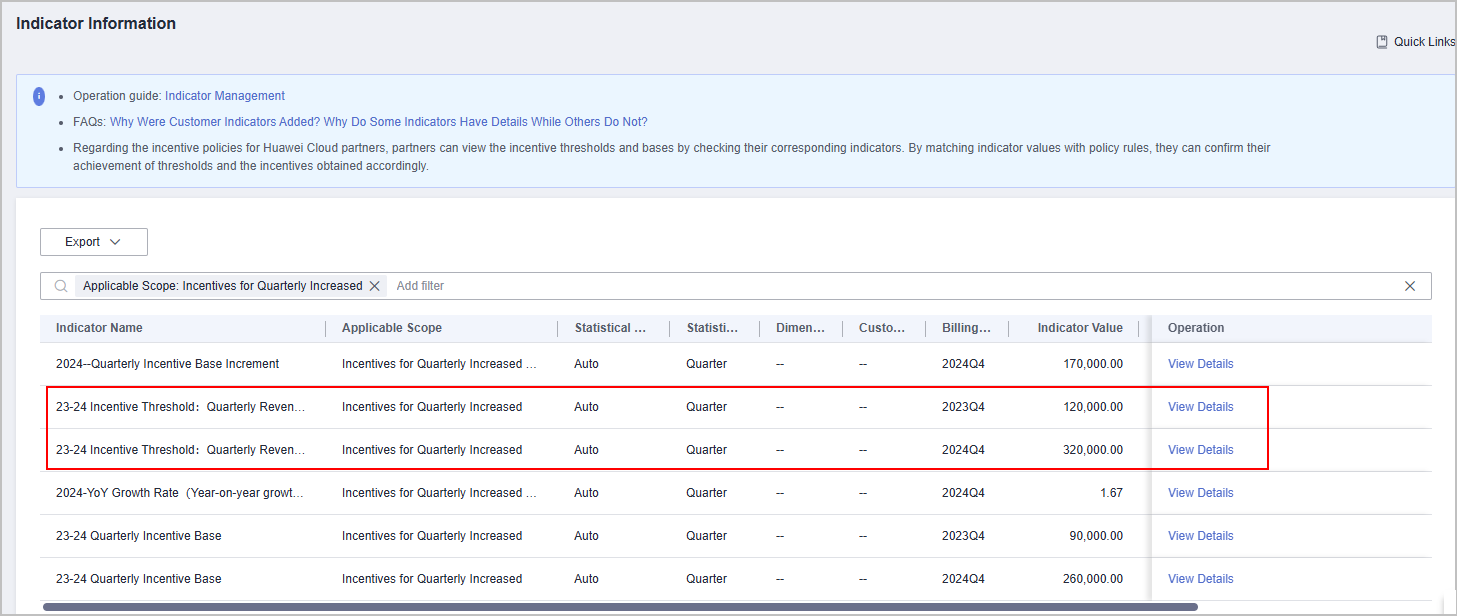

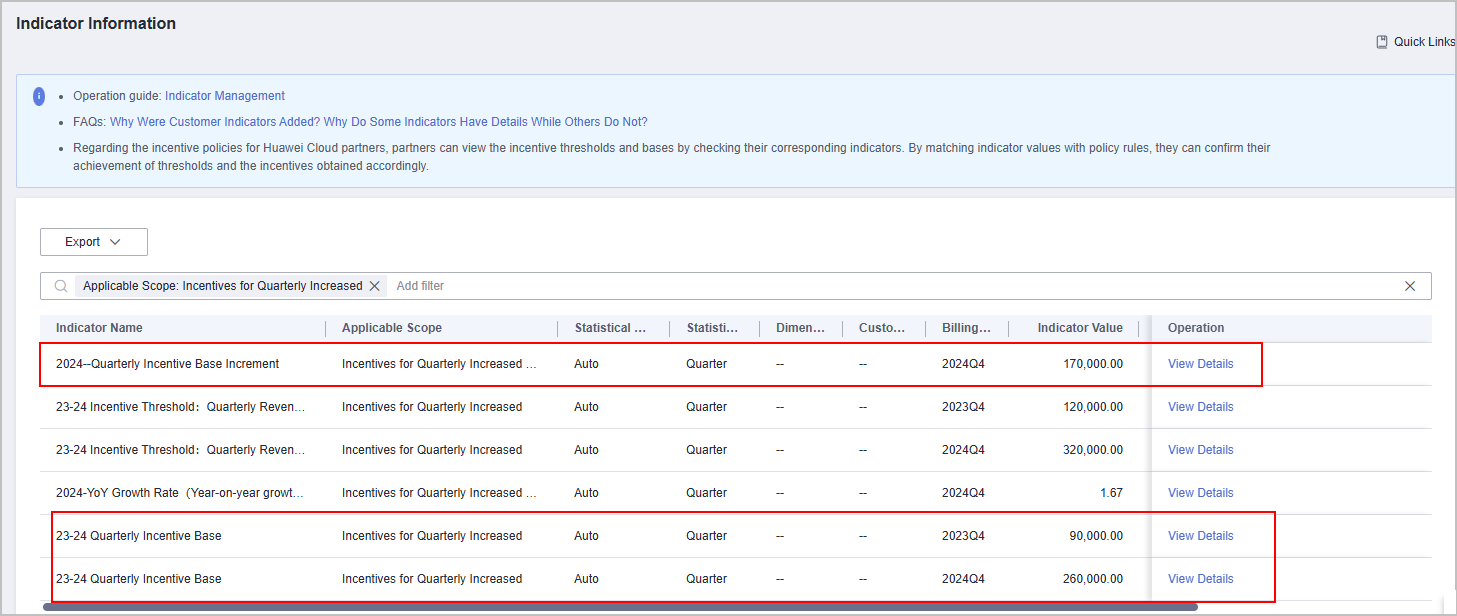

Log in to Partner Center and choose Sales > Incentives > Indicator Information in the menu on the top.

As shown in the preceding figure:

The incentive threshold for Q4 2024 is 320,000, which is greater than 30,000, meeting the incentive threshold requirements.

The incentive threshold for Q4 2023 is 120,000, the growth rate is calculated as follows: (320,000 – 120,000)/120,000 × 100% = 167%. This value is greater than 45%, meeting the growth rate requirement.

- Confirm quarterly incentive base increment in Q4 2024

The quarterly incentive base for Q4 2024 is 260,000.

The quarterly incentive base for Q4 2023 is 90,000.

Quarterly incentive base increment for Q4 2024 = 260,000 – 90,000 = 170,000

- Confirm the total incentive amount for increased revenues.

Total incentive amount for increased revenues = Quarterly incentive base increment × Rebate 4% = 170,000 × 0.04 = 6800

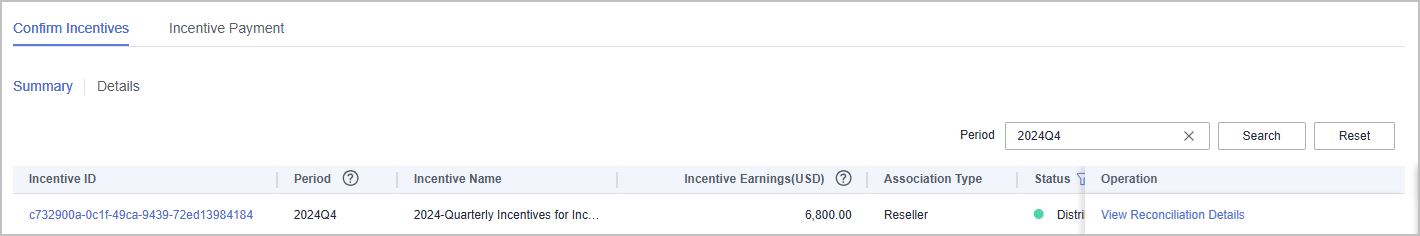

In Partner Center, choose Sales > Incentives > Incentive Management in the menu on the top. The Confirm Incentives > Summary page is displayed by default.

As shown in the figure, the incentive amount is the total incentive amount for increased revenues for Q4 2024.

- Confirm the incentive amount for a revenue.

Incentive for a revenue = Amount of the revenue × (Total incentive amount for increased revenues/Incentive base for Q4 2024)

Table 1 Incentive amount calculation for revenues Revenue Amount

Total Incentive Amount for Increased Revenues (6,800)/Incentive Base for Q4 2024 (260,000)

Incentive Amount for the Revenue

37823

0.026153846

989.2169231

86213

0.026153846

2254.801538

34212

0.026153846

894.7753846

92253

0.026153846

2412.770769

9499

0.026153846

248.4353846

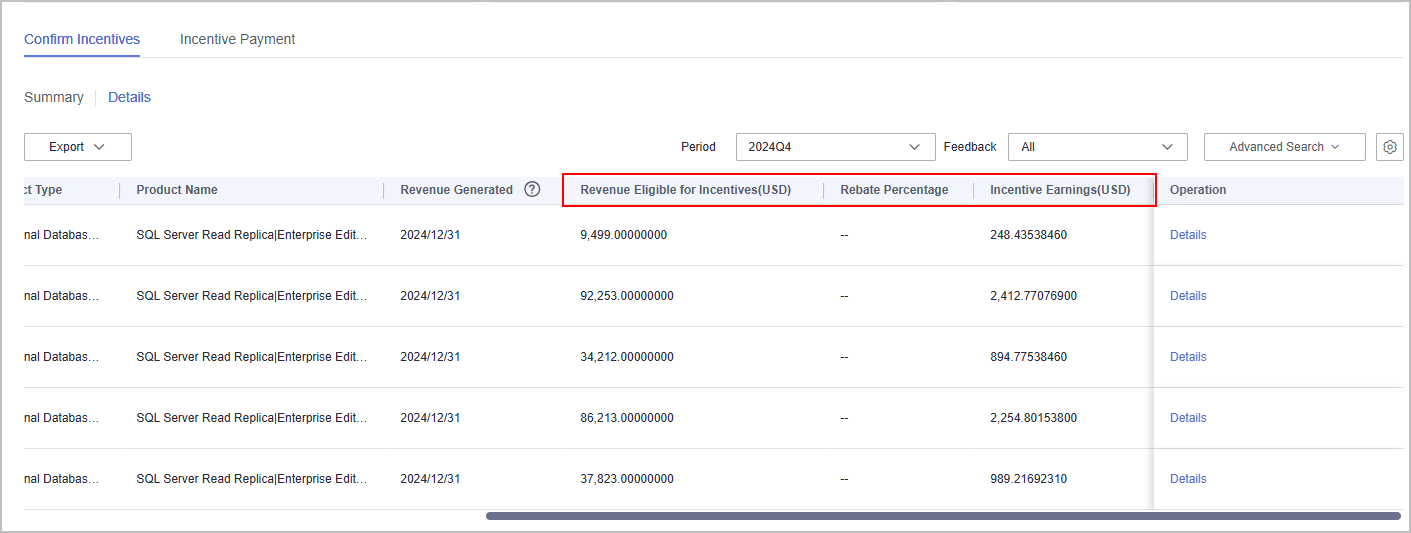

In Partner Center, choose Sales > Incentives > Incentive Management in the menu on the top. The Confirm Incentives > Summary page is displayed by default.

Switch to the Details tab and click Details in the Operation column to view the incentive details, including the customer name, product name, product type, rebate, rebate rule, and product incentive strategy.

As shown in the figure, the incentive amount for each revenue is consistent with the result in Table 1.

- The Revenue Eligible for Incentives field is not displayed by default. You can click Customize Column above the list and select this field.

- The number is accurate to eight decimal places.

- The rebate is displayed as --. If you have any questions, contact your ecosystem manager.

Feedback

Was this page helpful?

Provide feedbackThank you very much for your feedback. We will continue working to improve the documentation.See the reply and handling status in My Cloud VOC.

For any further questions, feel free to contact us through the chatbot.

Chatbot