Reconciliation Guidance

Reconciliation is to check the consistency between the bills created by HUAWEI CLOUD and the bills recorded by your company, so as to check whether your resource purchase and usage are consistent with the actual expenditures of your account. If you have any doubts about the bill, contact the HUAWEI CLOUD customer service by submitting a service ticket. If the bill provided by HUAWEI CLOUD has any errors, HUAWEI CLOUD will rectify them.

Bill Types

Summary bill: You can obtain it on the Billing Center > Bills > Dashboard page. A summary bill presents your summarized and cloud service–specific expenditures and unsubscriptions for a month. Summary bills are summarized from data on the Billing Center > Bills > Expenditure Items page.

Transaction bill: You can view transaction bills by month and obtain them on the Billing Center > Bills > Expenditure Items page.

Accuracy of Fee Deduction

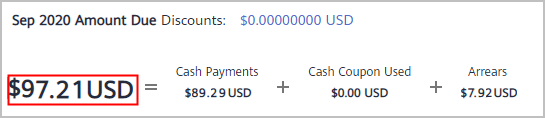

HUAWEI CLOUD bills the pay-per-use product with the fee accurate to eight decimal places (for example, $10.12501236 USD). Fees for pay-per-use expenditures are deducted together on the third day of the next month, accurate to two decimal places. For example, if the total pay-per-use expenditure amount is $100.12501236 USD, the actual fee charged is $100.12 USD.

Reconciliation Procedure

If you want to learn about your expenditures of the last month or your company needs account reconciliation, perform the following steps. Adjust the involved parameters as needed.

- Check the summary information.

On the Dashboard page, export the summary bill. In the Billing Overview area, you can see your monthly total fee and compare it with your expenditures displayed on Huawei Cloud. In the Expenditures and Unsubscriptions areas, you can see the used amount of cash coupons.

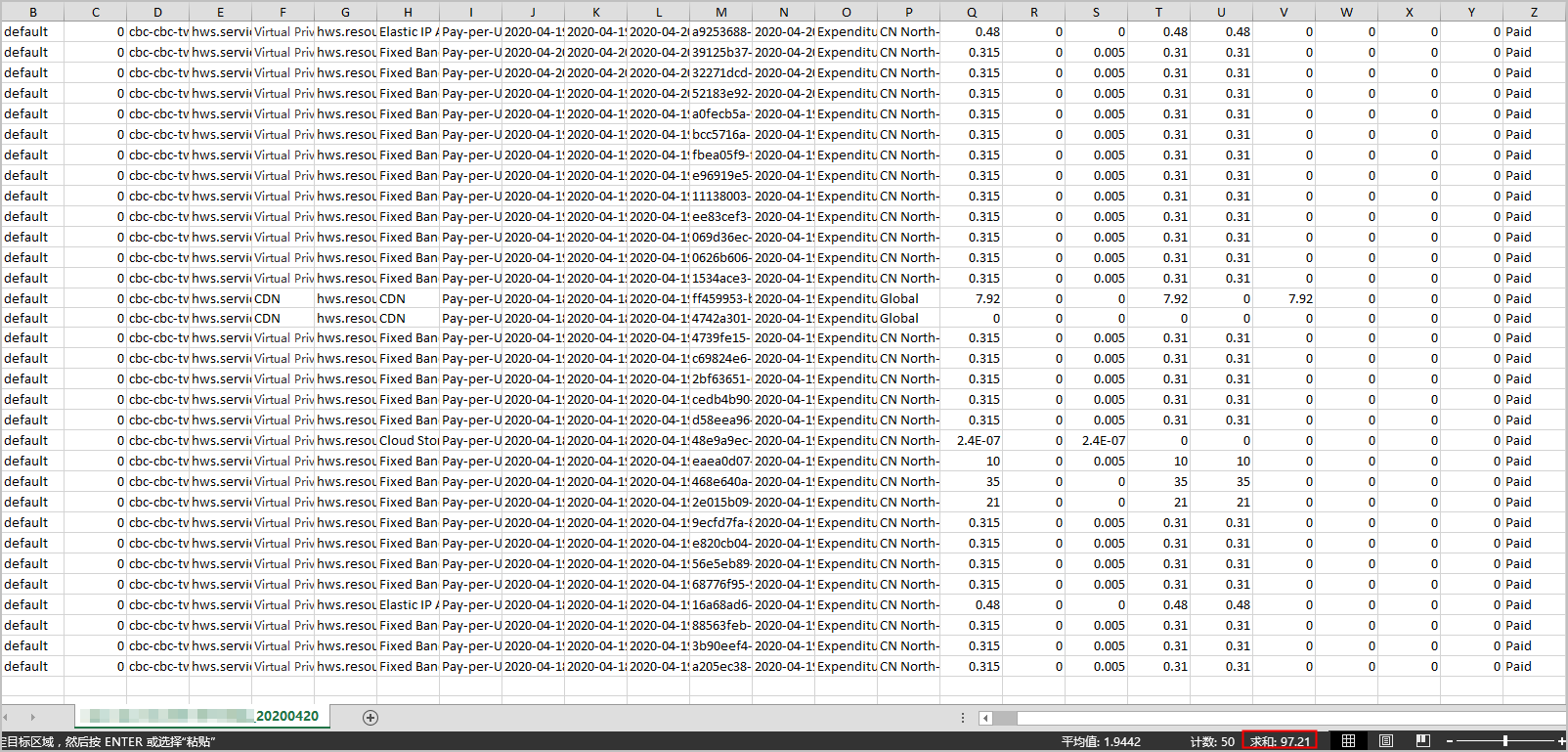

- Check whether the summary bill is consistent with the transaction bill.

- You can view the total amount due on the Billing Center > Bills > Dashboard page.

- You can export the transaction bill on the Billing Center > Bills > Cost Bill > Transaction Bills page and view the total amount due.

The bill types include:

- Expenditure-purchase: fees of yearly/monthly subscriptions

- Expenditure-renewal: fees of yearly/monthly subscriptions that you manually renew

- Expenditure-change: fees for changing the specifications of yearly/monthly subscriptions

- Expenditure-use: fees of pay-per-use products

- Expenditure-auto-renewal: fees of yearly/monthly subscriptions that are automatically renewed

- Expenditure-hourly billing: fees of hourly-billed reserved instances

- Expenditure-unsubscription service charge: handling fees charged for reserved instance unsubscription

- Expenditure-month-end deduction for support plan: fees charged for the support plan at the end of a month

- Expenditure-tax: tax for yearly/monthly and pay-per-use products

- Adjustment-compensation: fees compensated by Huawei Cloud

- Adjustment-compensation tax: tax for Huawei Cloud compensations

- Adjustment-deduction: fees paid when Huawei Cloud makes an account adjustment. For example, when Huawei Cloud adjusts a specification downgrade order, the original refund amount is paid first.

- Adjustment-deduction tax: tax for Huawei Cloud account adjustments

- Refund - unsubscription: fees of yearly/monthly products that are unsubscribed from

- Refund-change: fees of a yearly/monthly subscription for which the specification is downgraded

- Refund-tax: tax refunded when a yearly/monthly subscription is unsubscribed from

- You can view the total amount due on the Billing Center > Bills > Dashboard page.

Feedback

Was this page helpful?

Provide feedbackThank you very much for your feedback. We will continue working to improve the documentation.See the reply and handling status in My Cloud VOC.

For any further questions, feel free to contact us through the chatbot.

Chatbot