Purchasing Savings Plans

To help you save money, Cost Center provides you with customized savings plan recommendations based on your historical pay-per-use expenditures.

Important Notes

- Recommendations are currently available only for ECS Savings Plans.

- By default, your expenditures over the last 30 days are used as a reference for savings plans recommendations. If your pay-per-use expenditures fluctuate greatly or your identity (enterprise master or member account) has changed recently, take such factors into account when selecting a period for savings plans recommendations. When purchasing a savings plan, you can also adjust the upfront payment by adjusting your hourly commitment to avoid unnecessary waste caused by deviations from predicted use. (Currently, savings plans cannot be unsubscribed from.)

- Savings plans recommendations require up to eight days to reflect recent purchases of savings plans, yearly/monthly subscriptions, and reserved instances. When you select the historical data from the last 30 or 60 days as a reference for savings plans recommendations, the recommendations will be compared with those generated based on the historical data of the last 7 days. If it looks like a plan based on the most recent 7 days will save you more money than one based on the past 30 to 60 days, the plan based on the more recent data will be recommended. This is intended to help you avoid wasting money because of recent changes to your spending patterns.

- The estimated monthly amortized costs (after recommended purchase) are calculated based on the monthly amortized costs of the upfront payment and the hourly list price, without taking commercial discounts into account. The estimated monthly savings may be different from your actual cost savings.

Understanding Your Recommendation Calculations

To generate savings plans recommendations, Cost Center:

- Analyzes your hourly pay-per-use usage for the last 7, 30, or 60 days.

- Generates a savings plan based on your commitment term and payment option.

- Compares the cost of a savings plan with the actual pay-per-use cost over your selected period.

- Recommends the hourly commitment value that should result in the best savings and displays the estimated monthly expenditure, the estimated monthly amortized cost after purchase, and the estimated monthly savings.

- If the hourly pay-per-use amortized cost is less than $0.1 or the estimated monthly savings is less than $1, no savings plan purchase recommendations are provided.

- In unified accounting management, enterprise master accounts can view the following recommendations for purchasing savings plans:

- Recommendations at the master account level based on its own historical pay-per-use expenditures

- Recommendations at the member account level based on the historical expenditures of that member account during the unified accounting management period

- If an account has shifted from the master to the member or vice versa, savings plan recommendations are provided only for the current account identity.

Viewing Savings Plan Recommendations

- Access the Summary page.

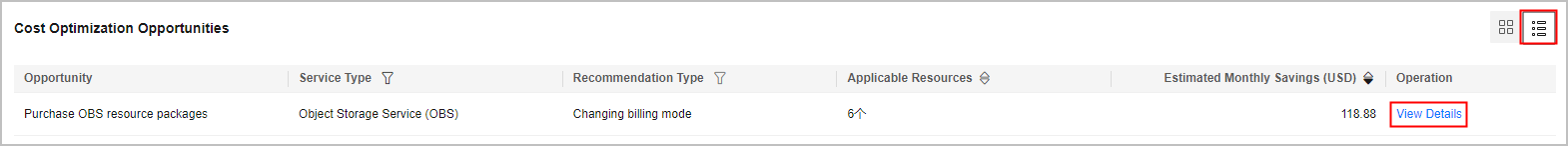

- In the Cost Optimization Opportunities area, locate the purchased savings plan and click View Details in the Operation column.

- Set the search criteria for savings plans.

- Data From: look-back period (7, 30, or 60 days). Pay-per-use expenditures from this period are used as reference to generate savings plan recommendations.

- Subscription Term: the term commitment, in years. It is either a 1-year or 3-year term.

- Payment Option: the way the savings plan is paid for. It can be all upfront, partial upfront, or no upfront.

- Recommendation Level: An enterprise master account can choose to view the savings plan recommendations by organization or account.

- Organization: Recommendations are generated at the management account level. They consider pay-per-use expenditures across all member accounts in the organization.

- Account: Recommendations are generated based on the pay-per-use expenditures of the individual account or at the member account level under unified accounting management.

- View savings plan recommendations.

- Estimated Monthly Savings: The monthly amount that could be saved if you adopt all recommended savings plans under the current query criteria. Estimated Monthly Savings = Estimated Monthly Expenditure Before Purchase – Estimated Monthly Amortized Cost After Purchase

- Estimated Monthly Expenditure Before Purchase: The monthly expenditures that may be generated for using pay-per-use resources under the current query criteria. Estimated Monthly Expenditure Before Purchase = Pay-per-use expenditures payable within selected days/Number of selected days/24 x 730

- Estimated Monthly Amortized Cost After Purchase: The estimated monthly costs that could have been saved if you had purchased the recommended savings plans under the current query criteria. Estimated Monthly Amortized Cost After Purchase = (Hourly commitment x 730) + (Pay-per-use expenditures beyond the savings plan commitment within selected days/Number of selected days/24 x 730)

When calculating savings plan recommendations, each month is treated as 730 hours long.

- (Optional) If you adopt the recommendations, click Buy Savings Plan in the Operation column of the specified savings plan. Then you will be redirected to the savings plan purchase page.

- Click

above the list of savings plan recommendations to export the recommendations.

above the list of savings plan recommendations to export the recommendations.

Table 1 Field details Field

Description

Linked Account

Used to filter savings plan recommendations by the enterprise master or member account associated with the current account

Service Type

Cloud services eligible for the savings plan

Site

Site that the savings plan is used for

Region

Region that the savings plan applies to

Specifications

Specifications eligible for the savings plan

Payment Option

Payment option of the savings plan, which can be all upfront, partial upfront, or no upfront

Subscription Term

Term of the savings plan, either one year or three years

Hourly Commitment

Hourly commitment recommended for the savings plan

Avg. Hourly Pay-per-Use Expenditure

Average hourly pay-per-use expenditure over the selected period

Min. Hourly Pay-per-Use Expenditure

Minimum hourly pay-per-use expenditure over the selected period

Max. Hourly Pay-per-Use Expenditure

Maximum hourly pay-per-use expenditure over the selected period

Estimated Average Utilization

Expected utilization percentage of the recommended savings plan over the selected period

Estimated Monthly Expenditure Before Recommended Purchase

Estimated monthly pay-per-use expenditure calculated based on the historical expenditure within the selected period

Estimated Monthly Expenditure Before Recommended Purchase = Avg. Hourly Pay-per-Use Expenditure x 730 hours

Estimated Monthly Amortized Cost After Purchase

Estimated monthly amortized costs if you had purchased the recommended savings plan

Estimated Monthly Savings

Estimated monthly savings after you purchase the recommended savings plan

Estimated Monthly Savings = Estimated Monthly Expenditure Before Purchase – Estimated Monthly Amortized Cost After Purchase

Operation

When you click Buy Savings Plan in the Operation column of the savings plan, you will be navigated to the savings plan purchase page.

Feedback

Was this page helpful?

Provide feedbackThank you very much for your feedback. We will continue working to improve the documentation.See the reply and handling status in My Cloud VOC.

For any further questions, feel free to contact us through the chatbot.

Chatbot