Stopping Billing

Yearly/Monthly Resources

You pay for a resource billed in yearly/monthly mode, such as a yearly/monthly RocketMQ instance, when you purchase it. Billing automatically stops when the subscription expires.

- If a yearly/monthly resource is no longer needed before the subscription expires, you can unsubscribe from the resource. The system will return a certain amount of money to your account based on whether cash coupons or discount coupons are used. For details about unsubscription rules, see Unsubscriptions. Note: Yearly/Monthly instances with recycling policies enabled will be moved to Recycle Bin upon unsubscription. After that, they will not generate fees, but their storage will. To stop billing, delete the instances from Recycle Bin.

- If you have enabled the auto-renewal function, disable it before the auto-renewal deduction date (seven days before the expiration date by default) to avoid unexpected fees.

Pay-per-Use Resources

If a pay-per-use RocketMQ instance is no longer needed, you can delete it to stop billing. Note: If recycling policies are enabled for pay-per-use instances, the instances will be moved to Recycle Bin upon unsubscription. After that, they will not generate fees, but their storage will. To stop billing, delete them permanently in Recycle Bin.

Searching for Resources from Bills and Stopping Billing

From bills, you can find the IDs of all resources that incur fees. Then find the specific resources based on the IDs, and delete the resources. To do so, perform the following operations:

- Choose Billing > Transactions and Detailed Bills.

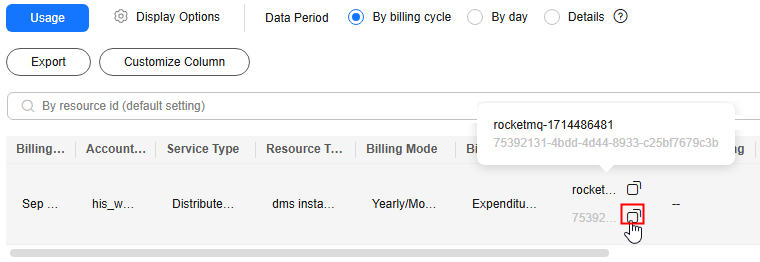

- Locate the row that contains the resource ID to be copied. Click the overlapping square next to the resource ID.

Figure 1 Copying resource ID

- Log in to the RocketMQ instance console.

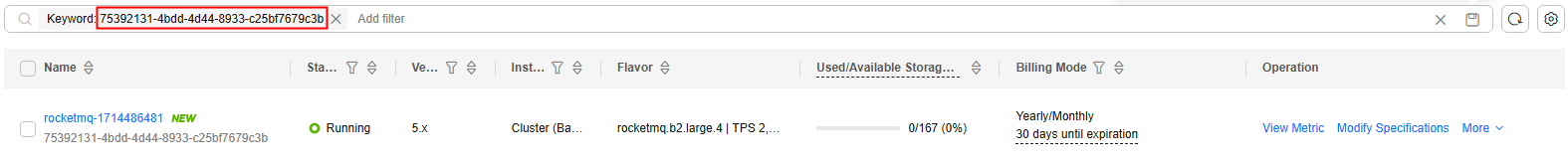

- Select the region where the resource is located, enter the resource ID in 2 in the search box, and press Enter.

If the RocketMQ instance is not found, it may have been deleted and be in Recycle Bin. In Recycle Bin, click the RocketMQ instance name to go to the instance details page. Check whether the resource ID in 2 is the disk storage ID. If yes, the resource is billed. If no, check other IDs until the resource is found.

Figure 2 Searching for resources

- Click More > Delete in the Operation column to delete the RocketMQ instance. Ensure that the RocketMQ instance does not exist in the list. If recycling policies are enabled, go to Recycle Bin and delete the instance again. If the resource found in 4 is already in Recycle Bin, click Delete in the Operation column.

The system usually deducts fees of the last settlement period within one hour after the products are used. As a result, after a pay-per-use resource is deleted, the bill information may still exist. For example, if you delete a pay-per-use RocketMQ instance at 08:30, the fees generated from 08:00 to 09:00 are usually deducted at about 10:00.

Feedback

Was this page helpful?

Provide feedbackThank you very much for your feedback. We will continue working to improve the documentation.See the reply and handling status in My Cloud VOC.

For any further questions, feel free to contact us through the chatbot.

Chatbot